Support your employees' work-life balance

Home benefits help your employees effectively balance work and personal life.

Complete Home Benefits

A 360° automated solution, respecting maximum regulatory amounts and with no cash advance.

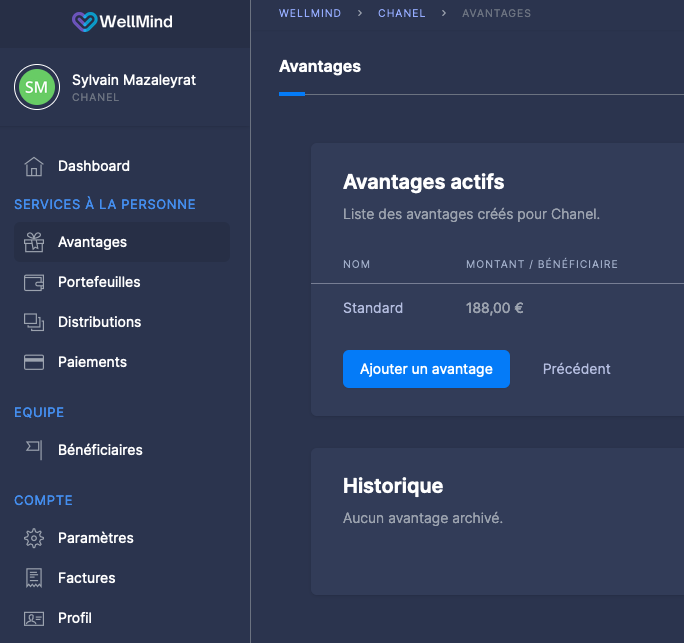

Your company distributes Home benefits to beneficiaries at the desired frequency

Wellmind respects maximum regulatory amounts: for France, the maximum amount is €2,540 per year per beneficiary. Your company distributes all or part of this amount to beneficiaries. You define the percentage of company participation in your beneficiaries' expenses. For example, if you set a rate of 60%, for €100 of housekeeping, you participate up to €60 and the beneficiary will be invited to pay the balance of €40. At this stage, no cash advance, you only commit to a maximum amount that your beneficiaries can use.

The beneficiary receives the distributed amounts in a virtual wallet

Your beneficiaries receive your distributions at the defined frequency in a secure virtual wallet with our payment provider. When the beneficiary wants to make an expense, they select their service provider and the amount to pay. If the company's participation is not 100% or the beneficiary wants to exceed their wallet balance, they can make a bank top-up by transfer. Banking transaction fees are offered by WellMind, the service being completely free for your beneficiaries. Your beneficiaries can pay any service provider by inviting them.

The service provider receives their invitation if they don't already have an account, then their payments by transfer to their bank account

The Personal Service provider can be a legal entity, a natural person, or an approved person (for childcare of children under 3 and under 18 with disabilities in particular). WellMind supports all use cases and verifies supporting documents when creating the account. Here too, WellMind covers transfer fees. The service is completely free for service providers.

The company is debited for its participation for each payment

Each operation can be debited individually from the company account or you can fund your account periodically, it's your choice. Detailed reporting and your invoices are available in your space. The company participates in the fees related to debits according to its package.

Why choose our Home Benefits?